What Are The Tax Brackets For 2025 Married Jointly. Gains on the sale of collectibles (e.g., antiques, works of. For example, if you’re married filing jointly for 2025 taxes with a taxable income of $95,000, you’d fall under the 22% tax bracket even though a majority of your taxable income.

To figure out your tax bracket, first look at the rates for the filing status you plan to use: How to file your taxes:

Irs 2025 Tax Tables Married Jointly Irina Leonora, This allows married couples to combine their income and deductions and file a single tax return.

Tax Brackets 2025 Married Jointly Calculator Excel Kassi Matilda, To figure out your tax bracket, first look at the rates for the filing status you plan to use:

2025 Irs Tax Brackets Married Filing Jointly Celine Lavinie, Publication 17 (2025), your federal income tax

Tax Brackets 2025 Married Jointly Over 65 Elyse Imogene, This allows married couples to combine their income and deductions and file a single tax return.

What Are The Tax Brackets For 2025 Married Jointly Tina Adeline, There are five main filing statuses:

Tax Brackets 2025 Married Jointly California Nerti Yoshiko, Let’s say you’re married filing jointly with $110,000 in taxable income.

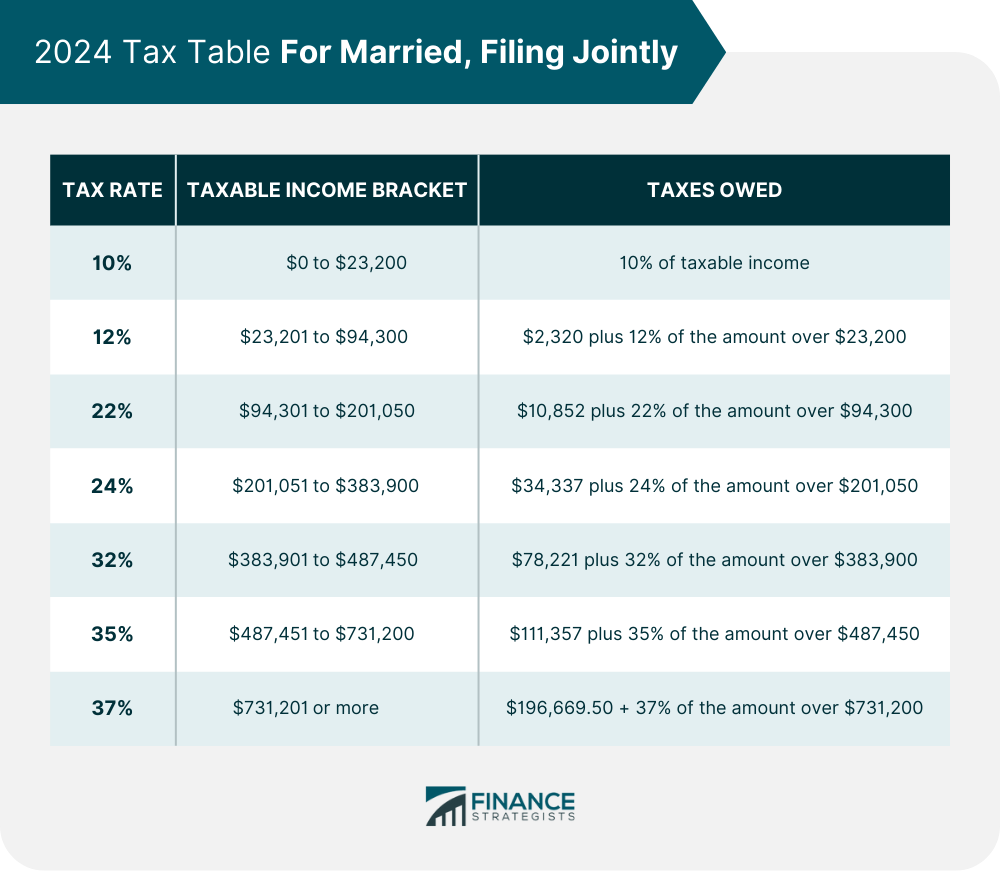

2025 Tax Brackets Calculator Married Jointly Delly Fayette, The federal income tax has seven tax rates in 2025:

Irs Tax Brackets 2025 Married Jointly Maren Sadella, For example, a married couple filing jointly will now be taxed at the top rate of 37% on income over $751,600.

2025 Tax Brackets Married Jointly Catharina, 10 percent, 12 percent, 22 percent, 24 percent, 32.